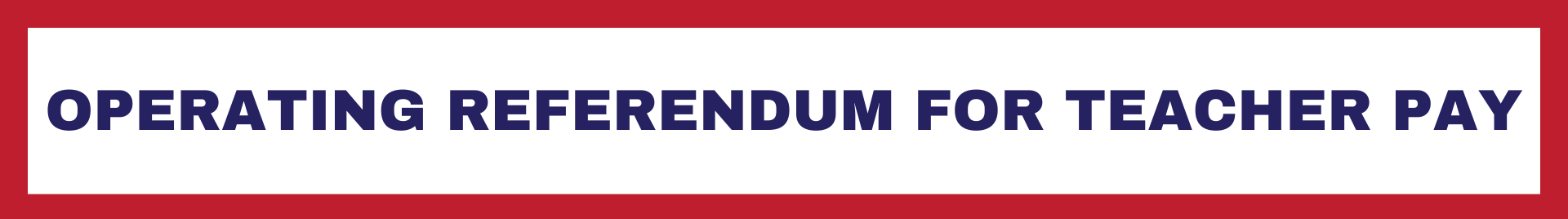

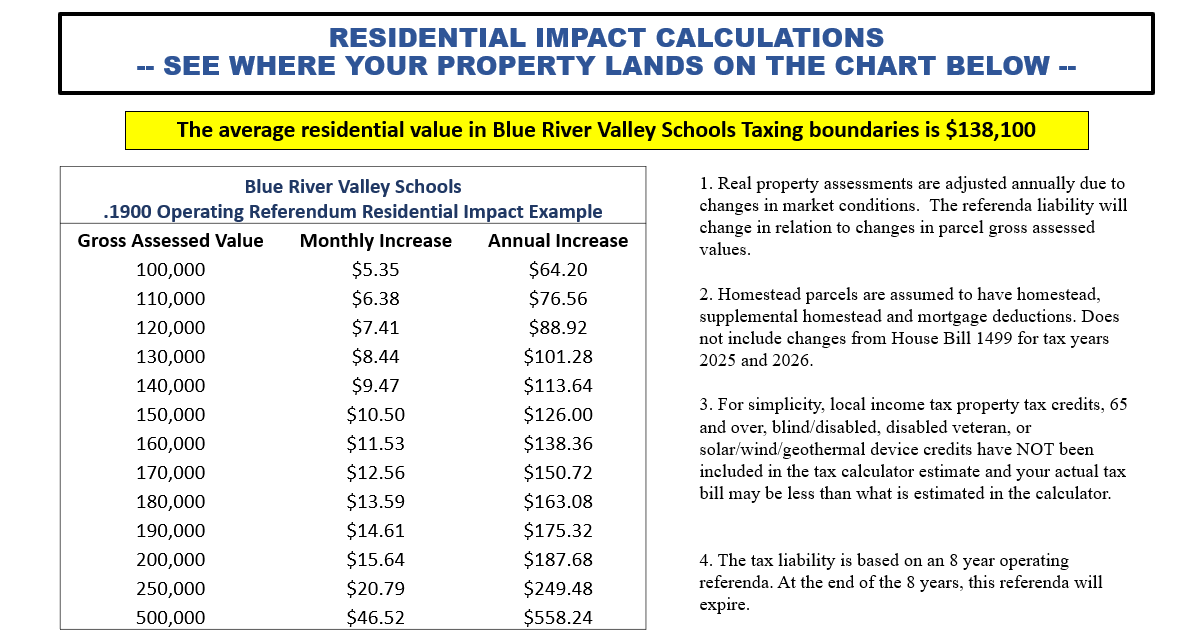

Proposed Impact Calculations

How much will your property taxes increase per year?

The average residential value in Blue River Valley Schools taxing boundaries is $138,100. The proposed $0.19 property tax increase, for the average residential valued home in Blue River Valley School district, would cost approximately $9.27 per month. While no one wants to raise taxes, this shared investment would greatly benefit the quality of education at Blue River Valley Schools.

Blue River Valley Schools has provided a tax calculator at the bottom of the Referendum Overview page. This is the best way to calculate your household's investment in our community.

Request More Information

Contact Superintendent Trent McCormick via phone or email.

765-836-4816

Trent.Mccormick@brv.k12.in.us